Are Indians buying more Bitcoin?

In today’s Finshots, we dig into the claim that India now holds one of the top Bitcoin stashes in the world and what that says about how we invest.

But before we begin, if you’re someone who loves to keep tabs on what’s happening in the world of business and finance, then hit subscribe if you haven’t already. If you’re already a subscriber or you’re reading this on the app, you can just go ahead and read the story.

The Story

There’s an estimate doing the rounds that says India now holds the second-largest stash of Bitcoin (nation-wise) in the world, right after the US. That’s nearly a million coins, or over 5% of the global Bitcoin supply. Roughly $120 billion worth.

It sounds insane. And it probably is.

There’s no confirmed blockchain data to back it but the estimate and the buzz still gives that more Indians are warming up to Bitcoin. It’s no longer just some fringe instrument.

And there’s some data to support the traction.

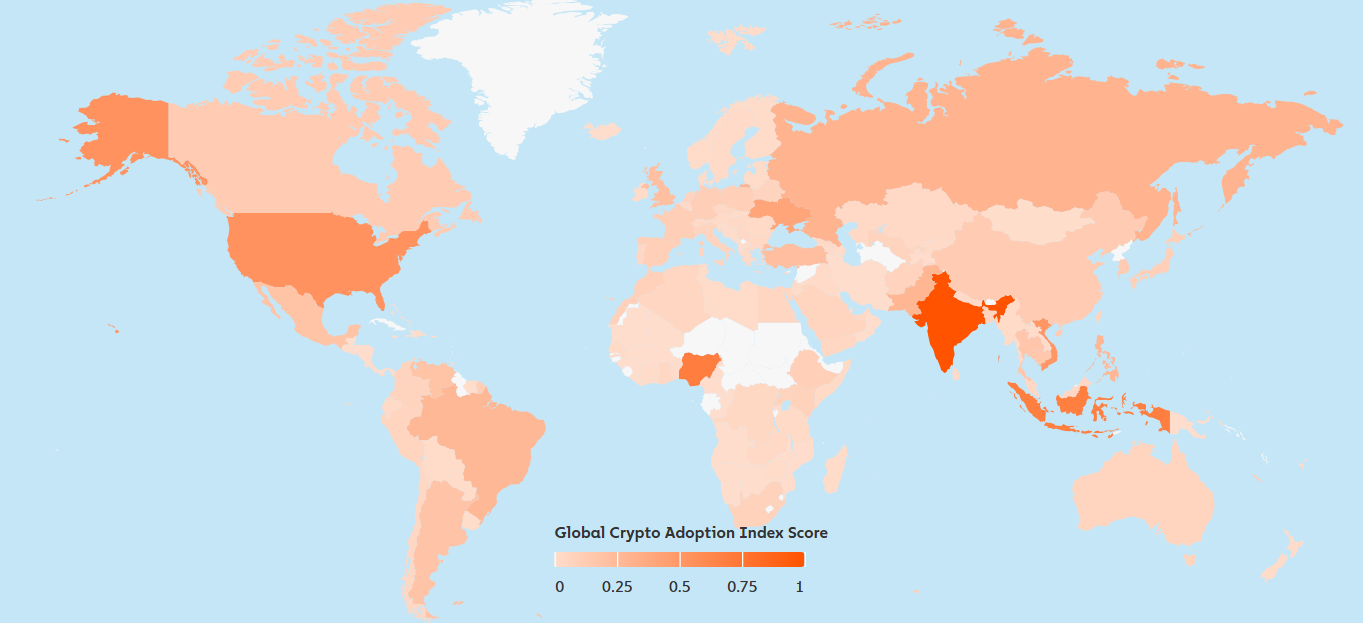

As of 2024, India ranks #1 in the Global Crypto Adoption Index compiled by Chainalysis.

Another estimate by Triple-A suggests that over 90 million Indians (roughly 8% of the population) now own some form of cryptocurrency.

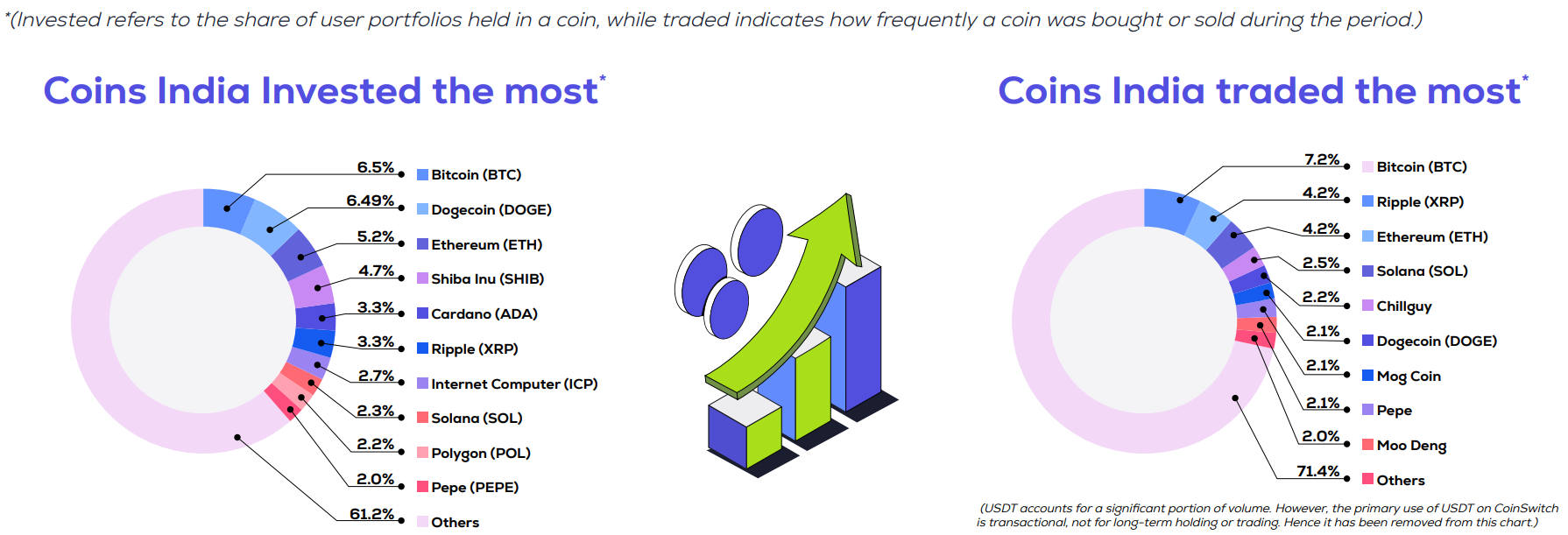

And when you check their crypto portfolio, it’s clear what they love most.

Sure, we don’t have wallet-level granularity but exchange platforms collectively show that Bitcoin is the top held and top traded cryptocurrency.

But the really interesting part is the split in holding.

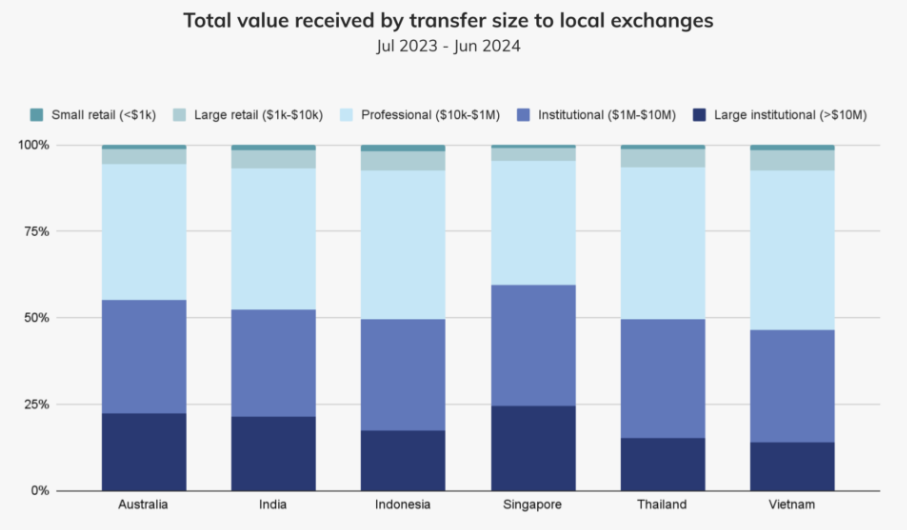

Even though millions of Indians own Bitcoin, most of the actual value might be concentrated in a narrow slice of investors. It’s a wide base, but most of the value is perched at the top.

That first image you saw above says Bitcoin holders are broadly retail base. But you need to see who that retail base is.

According to an Economic Times report, nearly half of CoinDCX’s trading volume comes from just 3,500 users (comprising high net worth individuals or HNIs, family offices, and institutions). And other platforms show the same pattern: the crowd is large, but the capital is concentrated.

We again have some more data to see where most of the value in Indian crypto moved from June 2023 to June 2024.

Most of the value received by local exchanges in India was from professionals with some serious cash to deploy.

That tells us two things.

One, a lot of Indians are still treating crypto like a casual investment. Two, the people who really believe in Bitcoin, as an asset class, are different from the rest. They are treating it like a serious allocation.

And hear me out on why this could be the case.

Bitcoin isn’t just a shiny speculative bet for HNIs. It’s part of their alpha-seeking portfolio. A small allocation (say 1–5% of net worth) into a high-upside, semi-mainstream, globally traded asset. Yes, taxes suck. But if you're already in the highest bracket, that’s just part of the game. You’re used to paying that kind of toll for access to asymmetric bets.

HNIs won’t be flying blind either. They have better access to global advisors, family office networks, exposure to foreign products (like Bitcoin ETFs). You could say they’re plugged into the network effect that Bitcoin rewards. The more people that buy in, the more the asset grows in value. And the earlier you get in, the more leverage you have on that growth. That applies to small retailer investors too but their view for this asset could be different. It’s often “put what you can afford to lose” versus “what % of my wealth do I park in this growing financial network?”

And that difference matters because this network is a global financial organism now ($2.2 trillion market cap). Especially appealing to people with surplus capital and alpha optionality.

Indian money supply growth has been rising, and that liquidity mostly flows to the top. Their spending doesn’t shoot up as much as compared to retail investors. So that extra cash seeks returns. And Bitcoin might be looking like an interesting bet to them today.

Especially in the backdrop of global uncertainty, Trump’s policies and trade wars.

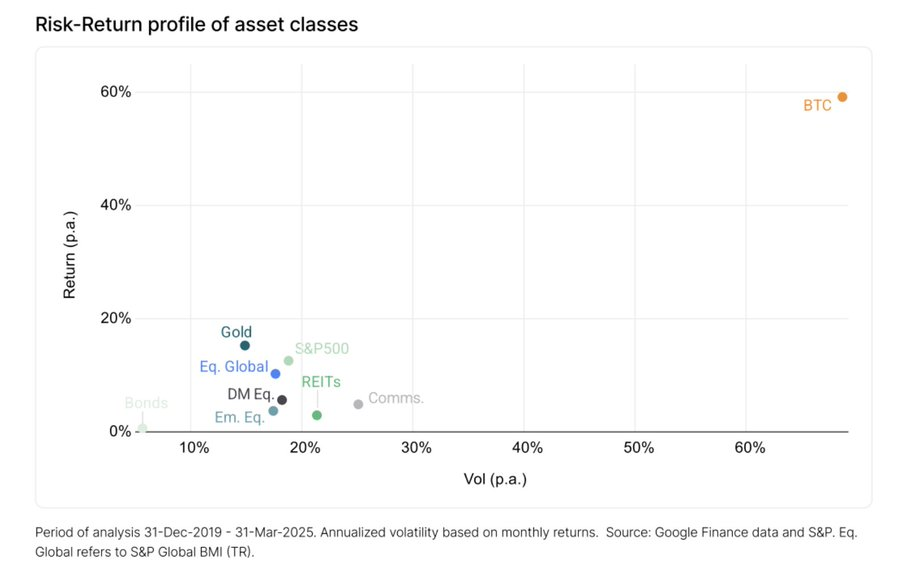

It has outperformed every major asset class for the past 15 years. Plus, it also moves in alignment with global liquidity.

Retail, on the other hand, is walking a different path.

It’s not that retail investors aren’t buying Bitcoin. They are. But they’re often buying smaller amounts, in scattered ways. Most aren’t thinking ‘alpha’, it’s more of a ‘Why not?’ It’s part of a mixed bag of exposure. And that’s not dumb. In fact, it’s smart experimentation.

31% taxes on gains won’t look good to retailers. The moment someone tries to take this seriously, they’re slapped with friction. And so, retail interest gets sandpapered down. Even if curiosity builds, the system isn’t built to welcome it. Especially when other investments with lower taxes offer more peace of mind.

Retail investors might also not be chasing optimisation. For many, it’s just about small exposure and slow accumulation.

See, here’s the thing. Most retail investors ask how high an asset can go. That is obviously an important question, but the more sophisticated ones ask “how much can I make given the risk I have to take?”

This is why Bitcoin has become an incredible portfolio addition to them. It’s risky, yes. But the potential upside still makes it a compelling bet if you know how to size your exposure right.

So yeah, that’s the story.

Are Indians really getting more into Bitcoin? Yes. But the conviction is skewed, the capital is concentrated and the intent is mixed.

Still, the signal is clear: India’s investing class is no longer ignoring Bitcoin.

And like most things in motion, this momentum could keep rolling – whether it's retail or HNIs trickling in.

There will be plenty of volatility along the way, including full-blown bear markets. And with Bitcoin trading 24/7 and massive hands moving volumes, you can’t say for sure any of this holds a few days from now.

Maybe where India’s Bitcoin story heads next depends on who joins the adoption journey. Will institutions finally step in, will policymakers shape the rules, or will retail keep inching forward despite the friction?

Until then…

If this story helped you make sense of India's growing but complicated love for Bitcoin, don't forget to share it with your crypto bros or even die-hard skeptics on WhatsApp, LinkedIn and X.

Still trying to wrap your head around crypto? Check out Finshots Cracks Crypto — where we break down the basics of cryptocurrencies, blockchain and Bitcoin!

🔊Introducing Pitch Perfect 2025!

If you've been following us for a while, you know our story didn't begin in a corporate boardroom. It started in a college dorm room with 3 broke students who chose to skip placements and chase something bigger.

That something was Finshots.

Today, Finshots reaches over 500,000 readers, and through Ditto, we've empowered 800,000+ Indians to make smarter insurance decisions.

Now, we're looking for the next game-changing idea to back.

Introducing Pitch Perfect 2025 – a flagship startup pitch challenge powered by Zerodha.

So, if you've got a BIG idea that could help Indians get better with money, pitch it to us!

What's at stake:

✅₹10,00,000 in prizes

✅Potential funding from Zerodha Rainmatter

✅All-expenses-paid trip to Bangalore to pitch directly to Nithin Kamath and industry veterans

Ready? 👉Apply Now!