The Amagi Media Labs IPO Explained

In today’s Finshots, we break down the Amagi Media Labs IPO, which opens for subscription tomorrow, and closes on 16 January, 2026.

But here’s a quick note before we begin. If you’re someone who loves to keep tabs on what’s happening in the world of business and finance, then hit subscribe if you haven’t already. If you’re already a subscriber or you’re reading this on the app, you can just go ahead and read the story.

The Story

For decades, television broadcasting was a game for the rich. If you wanted to run a TV channel, you needed satellites, antennas, long-term carriage agreements with cable operators, and a mountain of physical infrastructure just to get your content in front of viewers.

Distribution was expensive, slow to scale, and heavily controlled by a few gatekeepers. Fast forward a few decades, and the internet quietly started eating into the television market.

First came the likes of YouTube. Then streaming platforms such as Netflix. And finally, after COVID, which accelerated a shift that was already underway, viewers stopped caring where content came from. They just wanted it on-demand, on any screen, anywhere, and at any time. Suddenly, the idea that you needed a satellite in space to run a TV channel started sounding outdated.

In a way, you can say that Amagi Media Labs helped fuel that shift.

That’s because Amagi doesn’t rely on satellites or heavy hardware. Instead, it offers a cloud-based software platform that lets media companies distribute, manage, and monetise content digitally. So broadcasters no longer need to negotiate with cable networks or pay for expensive bandwidth. They can launch channels across connected TVs and streaming platforms using just software.

And that change is quite structural. Amagi sits at the backbone of this new ecosystem. It helps content owners schedule shows, insert ads in real time, manage ad inventory, and make money across platforms, all through the cloud. That way, broadcasters don’t have to spend heavily on their own infrastructure.

This shift has also made Amagi a global business almost by default. Because more than 70% of its revenue comes from North America. Europe accounts for another 17%.

Apart from this, the company works with over 400 content providers across 40 countries. That diversification means Amagi’s revenue isn’t tied to the health of Indian television or any single broadcaster.

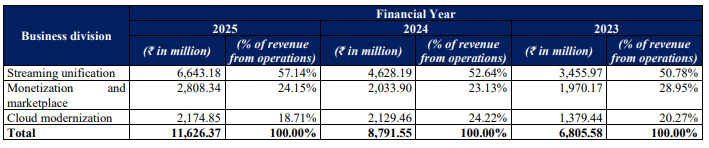

This brings us to how Amagi makes money. They have three primary revenue streams:

- Streaming unification (57% of revenue):

Think of this as Amagi’s plumbing layer. Different streaming platforms or broadcasters have slightly different tech stacks, reporting systems, etc. For a content owner, managing all of this separately is a nightmare. Amagi solves this by acting as a single bridge between these two parties.

A TV channel uploads its content once, and Amagi’s software automatically adapts, schedules, and delivers that content across dozens of FAST (Free Ad-supported Streaming Television) and OTT platforms globally. This is Amagi’s core product and its biggest revenue driver.

- Monetisation & Marketplace (24% of revenue):

This is where Amagi starts behaving like a stock exchange. FAST TV is free for viewers. So the entire business runs on ads. But matching the right advertiser with the right channel, audience, geography, and time slot is complicated.

Amagi sits in the middle, connecting advertisers who want targeted reach with content owners who want ad revenue. It manages ad inventory, pricing, targeting, delivery, and measurement. When the ads run, money flows to the content creator, and Amagi takes a cut of that ad revenue as its fee.

- Cloud monetisation (19% of revenue):

Many broadcasters still run parts of their operations on legacy, on-premise systems. Amagi helps them move these workflows to the cloud. It provides tools for content management, playout, monitoring, and reliability. Think of it as modernising a TV channel’s backend without them having to build anything themselves.

And now that you know how Amagi works and makes money, let’s talk about the IPO.

On paper, Amagi looks like a clean play on the future of broadcasting, riding the OTT and FAST wave. Exactly the kind of business public markets usually like. But the story isn’t without friction.

The most immediate concern is cost. Amagi has historically operated with very high operating expenses because cloud infrastructure isn’t cheap when you’re running mission-critical systems at a global scale. While margins have improved in recent years, the company reported its first year of profitability only last year, more than a decade after its founding.

That timing matters because investors now have to decide whether profitability is the beginning of a steady trend or simply the result of temporary cost discipline. As Amagi continues to scale, invest in technology, and expand into new markets, will margins hold or will costs creep back up?

Then there’s the industry itself. Traditional television viewership has been declining for years as audiences migrate to on-demand and ad-free platforms. Linear TV, which once formed the backbone of broadcasting economics, is clearly in long-term decline. Amagi benefits from this transition, but it is still tied to the broader media ecosystem.

If advertising budgets tighten during economic slowdowns, or if platforms consolidate and bring more technology in-house, spending on third-party solutions could come under pressure. Broadcasters may love software that reduces costs, but they also cut vendor spending when margins shrink.

There’s also competition to think about. OTT monetisation is a growing opportunity, but it’s not an empty field. Large technology companies already operate at massive scale in advertising, cloud infrastructure, and AI. Amagi’s edge comes from its focus and specialisation. It understands broadcasters deeply and builds specifically for their needs. But maintaining that edge will require continuous investment.

And this is where the IPO’s stated use of proceeds becomes important.

The IPO is worth ₹1,789 crore, of which ₹973 crore is an offer for sale. Of the remaining ₹816 crore being raised through a fresh issue, Amagi says about ₹550 crore will go into technology and infrastructure. The rest will be used for general corporate purposes and inorganic growth, which essentially means acquiring competitors. So the company isn’t just content with riding the wave, but also wants to consolidate smaller players and deepen its moat. If executed well, this could strengthen its position as a core infrastructure provider. But if executed poorly, it could dilute focus and strain margins.

So how should you think about this IPO?

At its core, Amagi is a bet on how television entertainment evolves, and not how it used to be. It’s a bet that free, ad-supported streaming grows faster than subscription-only models, and that content owners continue to prefer flexible, software-driven distribution over owning heavy infrastructure, which is a fair bet.

If those assumptions hold, Amagi sits in a very attractive position. But it’s also a reminder that infrastructure businesses don’t become boring utilities overnight. They go through phases of experimentation, volatility, and constant reinvestment before settling into predictable cash flows. Amagi is still in that proving phase.

Its valuation makes that clear. At the upper end of the price band (of ₹361 per share), Amagi is valued at about ₹7,800 crore or nearly 7 times its FY25 revenue (from operations) of ₹1,162 crore. That revenue has grown at a solid 30% CAGR (compound annual growth rate) over the last two years. But the catch is that there’s no listed peer, in India or globally, to anchor expectations. So there’s no easy way to say whether this is cheap or expensive just yet.

Which is why this IPO is about who builds the pipes for its digital future.

Investors now have to decide whether Amagi becomes the backbone of global streaming and ad-supported TV or remains a niche technology provider that benefited from a one-time transition. That answer won’t come from listing day price action, but from how well the company converts scale into sustainable profits once the growth story matures.

And that’s what makes the Amagi Media Labs IPO interesting.

Until next time…

If this story helped you understand the television broadcasting industry and the Amagi Media IPO, share it with your friends, family, or even strangers on WhatsApp, LinkedIn, and X.