A CEO can't be Eternal, how DISCOMs turned profitable, and more...

In this week’s wrap-up, we talk about the Shadowfax Technologies IPO, why the government is regulating hair transplants, the economics behind a common language, why electricity distribution companies have turned profitable, and why Indians are scared to invest in the stock market.

Also, in this week’s Markets edition, we talk about the curious case of Eternal (Zomato)’s latest results & Deepinder Goyal’s exit. You can read it here.

With that out of the way, let’s take a look back at what we wrote this week.

The Shadowfax Technologies IPO

Try to picture the last time your doorbell rang for a delivery. It could’ve been a Zomato order, a long-awaited Flipkart package, or a return pickup. You probably remember the item. But not the company stitched onto the delivery person’s jacket.

Shadowfax Technologies is one of the invisible players behind that moment. It doesn’t sell to you directly. Instead, it helps e-commerce and quick-commerce platforms move parcels from warehouses to homes, quietly handling the most complicated part of the journey — the last mile.

And that last mile isn’t easy. Logistics is a game of scale, razor-thin margins, and brutal demand swings during sales and festive seasons. Efficiency often decides who survives. Shadowfax has grown by building a wide delivery network and spreading its technology and operating costs across millions of shipments. Whether that scale can turn into a sustainable business is the question the IPO puts in front of investors.

Read the full breakdown of the Shadowfax Technologies IPO in our Monday edition here.

India is finally cracking down on hair transplants

Hair loss is hitting Indian men earlier than ever. Nearly half experience it by 25. And as anxiety rises, so does the demand for hair transplants.

But here’s the uncomfortable part. A booming, lightly regulated industry has attracted dubious operators, blurred the line between cosmetic treatment and surgery, and, in some tragic cases, cost lives.

Which is why the government wants to step in and treat hair transplants strictly as surgery.

But the real question is: Why did regulation take so long, and will tighter rules actually make things safer?

We answered that in Tuesday’s newsletter. You can read it here.

The economics behind a common language

Language is usually framed as culture or identity. But looked at through an economic lens, it behaves more like infrastructure. A shared language lowers coordination cost, improves labour mobility, and helps different markets integrate faster. That’s why countries like France once pushed for linguistic standardisation to unify their economies.

However, in diverse countries like India, the cost of adopting a common language isn’t evenly shared. Some groups gain easier access to jobs and capital, while others face a much higher learning cost.

So language debates aren’t just emotional or political. They’re about who pays for coordination and who benefits from it.

So, is linguistic unity worth the economic imbalance it can create? Find out more in our Wednesday story.

The DISCOM profit anomaly

Electricity is something most of us take for granted — until it’s suddenly not there. For years, India’s power distribution companies, better known as DISCOMs, were almost always in the red, struggling under mountains of debt and persistent losses that seemed impossible to shake off.

But recently, something changed: collectively, these DISCOMs reported a profit for the first time in over a decade. On the surface, it looks like a turnaround for a sector long plagued by inefficiencies and unpaid bills.

In our Thursday edition, we peel back what’s really happening behind those numbers — and why this sudden profitability might not mean DISCOMs have suddenly cracked the code on efficient power distribution. It’s the kind of twist that makes you rethink what balance sheet profits actually tell us about an industry so essential to everyday life.

Read the full breakdown of the DISCOM profit anomaly here.

Why are Indians scared to invest in the stock market?

SEBI’s latest investor survey reveals a puzzling gap. The latest SEBI investor survey found that 63% of Indians surveyed are aware of the stock market, but only 9.5% actually invest. The problem isn’t access or regulation. It’s something completely different.

You see, for many households, the markets feel confusing and emotionally hard to live with. Digital platforms made investing easier to enter, but also pushed all decisions onto individuals, without reassurance or clear mental models. So, when volatility hits, as it usually does, people pull out.

Therefore, if we want more people to participate in the market, investing can’t feel like a constant test of judgment. It has to become routine, default, and survivable when things go wrong.

What exactly can we do to improve participation, you ask? Read our Friday story to find out more.

Finshots Weekly Quiz v2.0 🧠

Hey folks! A few months ago, we hit pause on the Finshots Weekly Quiz because we were cooking up something new. And last month, we finally unveiled the Finshots Weekly Quiz v2.0. If you missed out, don’t worry. Click here to check out the rules and set a reminder to participate consistently starting next month!

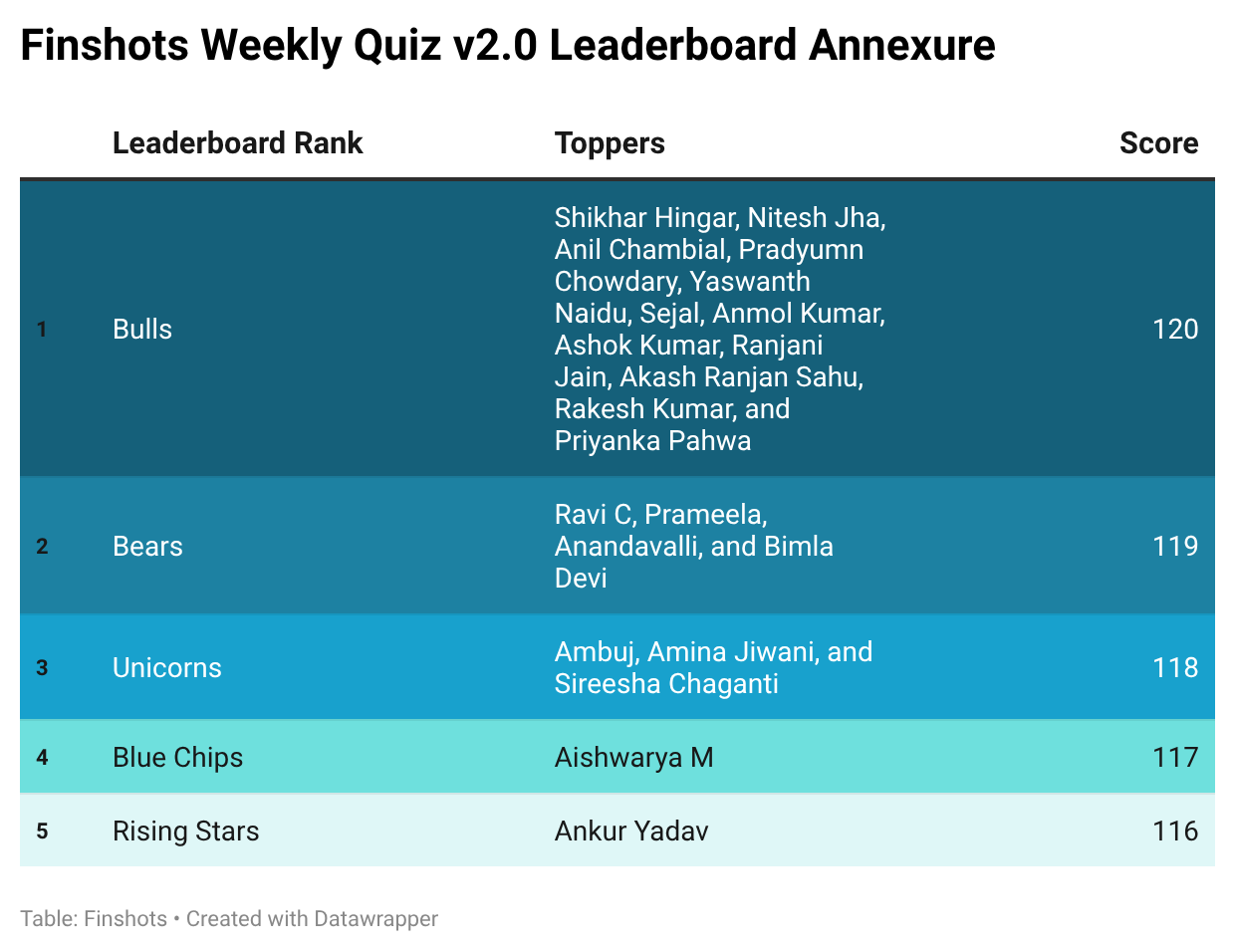

But for now, it’s time to announce the top scorers of our previous weekly quiz. There were a whole bunch of you who participated, and many of you ended up with the same scores. So we’re calling you Bulls, Bears, Unicorns, Blue Chips, and Rising Stars. Here’s how the leaderboard looks right now:

If your name has been featured on the leaderboard, then congratulations! If not, don’t lose hope. If you attempted last week’s quiz, keep at it and answer all the weekly quizzes this month. You never know when the turntables! Click on this link to take this week’s quiz, which is open till 12 noon, Friday, 30th of January, 2026. The more answers you get right, the better your chances of appearing on the Finshots Weekly Quiz leaderboard. We’ll publish it every Saturday in the Weekly Wrapup. And the winner will be announced in the first week of February.

Liked this week’s wrapup?

Don’t forget to share it with your friends, family, or even strangers on WhatsApp, LinkedIn, and X. And subscribe to Finshots, if you haven’t already. Plis!

How Strong Is Your Financial Plan?

You've likely ticked off mutual funds, savings, and maybe even a side hustle. But if Life Insurance isn't a part of it, your financial pyramid isn't as secure as you think.

Life insurance is the crucial base that holds all your wealth together. It ensures that your family stays financially protected when something unpredictable happens.

If you’re unsure where to begin, Ditto's IRDAI-Certified insurance advisors can help. Book a FREE 30-minute consultation and get honest, unbiased advice. No spam, no pressure.